Friends Axita Cotton Ltd is a prominent player in the cotton industry, company has been gaining attention from retail investors due to its consistent sales and profit growth with expanding market presence. Axita Cotton is manufacturing and exporter of cotton bales clients across India. With its financial performance if you want to know, what can be the Axita Cotton Share Price Target 2025 to 2050? This article will explore the company’s detail financial background with last 10 years of analysis , share price history, and potential future share price targets.

Axita Cotton Company Information

This company was established in 2013, Axita Cotton is a leading manufacturer and main exporter of high-quality cotton bales and with good quality cotton yarn. Axita Cotton Ltd founded as a partnership firm in 2007 under the name Aditya Oil Industries, initially this company focused on cottonseed oil production. After few years, Axita Cotton has diversified its product range that’s include various types of cotton bales, cotton seeds, and specialized cotton such as BCI and organic cotton and etc. The company’s main ginning and pressing plant, located in Gujarat, This plant is strategically placed near cotton-rich regions, that is giving it a strong competitive advantage to Axita Cotton company. This company serves global markets like Bangladesh, China, and Indonesia, and so many countries, Company has a strong clientele that includes well-known brand like DongKhanh, Hoatho, and KPR Mill.

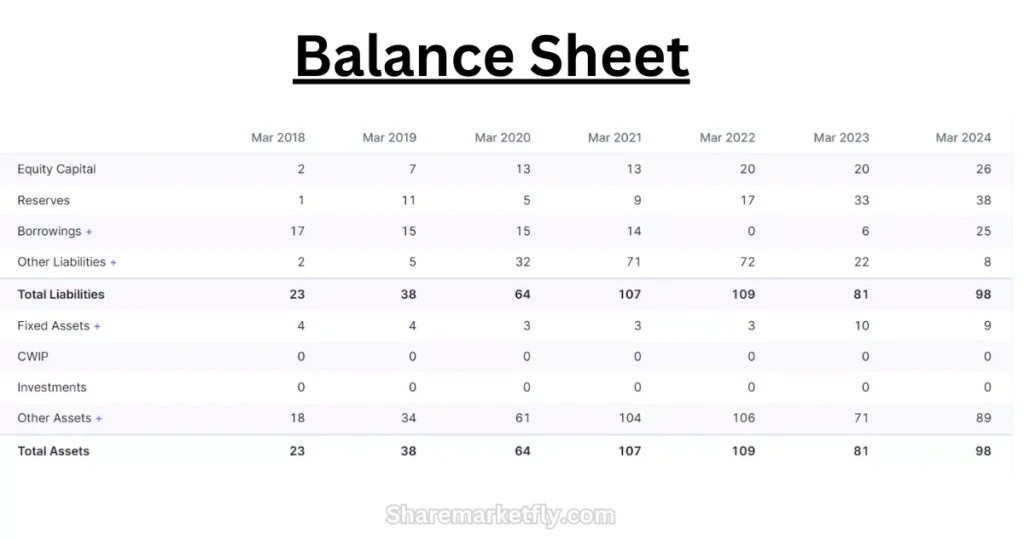

Axita Cotton Financial Overview

Before knowing about Axita Cotton share price targets you need to know about financial overview. Company has witnessed robust financial growth in recent years, with a nearly 113% compound annual growth rate (CAGR) in profits over the last financial 5 years. This company reported a market capitalization of ₹604 crore, with a current stock price of ₹17.4 as of 20 September 2024. Despite some challenges, Axita Cotton has consistently delivered strong and good returns, with a Return on Capital Employed (ROCE) is 37.9% and a Return on Equity (ROE) is 34.8%. The company’s main revenue in FY23 was primarily driven by cotton bales, which accounted for 85.91% of its sales, and the remaining revenue coming from cotton yarn and other products of company.

| Axita Cotton Ltd | Ratios |

|---|---|

| Market Cap | ₹ 604 Cr |

| Face Value | ₹ 1 |

| Book Value | ₹ 1.86 |

| PE ratio | 33.3 |

| ROCE ratio | 37.9% |

| ROE ratio | 34.8% |

| Dividend Yield | 0.76 % |

| 52-wk high | 26.6 Rs |

| 52-wk low | 14.5 Rs |

This company was listed on the stock exchange in 2018, and since then, its share price has experienced significant profit and sales growth. Main part is the stock price has delivered a CAGR of 58% over the last 5 years. Good news is Axita Cotton migrated from the SME Platform to the Main Board of BSE and NSE in 2022, and further enhancing its visibility and awareness in the market. However, the stock has also experienced volatility in some months, with a high of ₹26.6 and a low of ₹14.5 in last few month trading history. But still this company’s strong financial performance with profit and sales growth potential have contributed to its rising share price over time.

This company’s growth trajectory and its expansion into international markets, Therefore Axita Cotton share price target for 2025 will be 24 Rs to 40 Rs.

| Axita Cotton Share Price Target 2025 | Rs |

| First Target | 24 |

| Second Target | 33 |

| Third Target | 40 |

Axita Cotton’s strong financials, coupled with increasing demand in future for cotton products globally, are expected to drive this better growth. But some factors such as the company’s buyback initiative. And strategic orders worth ₹89.22 crore will further boost all types of investor confidence.

Looking ahead to 2026, This company is expected to further solidify its position in the whole cotton industry, both domestically and globally. Therefore Axita Cotton share price target for 2026 will be 45 Rs to 75 Rs.

| Axita Cotton Share Price Target 2026 | Rs |

| First Target | 45 |

| Second Target | 57 |

| Third Target | 75 |

As the Axita Cotton continues to expand its production capacity with increasing sales and secure more global contracts, all retail investors are likely to see steady and fixed growth in the stock’s value.

Axita Cotton share price target 2027 is anticipated to be in the range will be 80 Rs t 110 Rs.

| Axita Cotton Share Price Target 2027 | Rs |

| First Target | 80 |

| Second Target | 95 |

| Third Target | 110 |

In future with the increasing demand for organic and sustainable cotton, Axita Cotton is well-positioned to capitalize on all types of trend. The company’s main efforts to increase its export share with its ability to maintain a healthy and good profit margin will be key factors driving its share price growth in the future.

In 2030, Axita Cotton is expected to have a more mature presence in worldwide markets with increasing and stable growth. Therefore share price target 2030 will be 150 Rs to 270 Rs.

| Axita Cotton Share Price Target 2030 | Rs |

| First Target | 150 |

| Second Target | 210 |

| Third Target | 270 |

The company is mainly focus on innovation, expansion, and maintaining its global client base with good quality production. This will contribute to its long-term success.

By 2040, Axita Cotton’s share price could potentially reach between 550 Rs to 760 Rs.

| Axita Cotton Share Price Target 2040 | Rs |

| First Target | 550 |

| Second Target | 640 |

| Third Target | 760 |

In next 20 years, the company is expected to continue its huge growth by expanding into new international markets, increasing quality production capacity, and capitalizing on government policies that benefit more exporters.

Axita Cotton share price target 2050 will be between 1450 Rs to 1850 Rs.

| Axita Cotton Share Price Target 2050 | Rs |

| First Target | 1450 |

| Second Target | 1690 |

| Third Target | 1850 |

This company is assuming continued global expansion, advancements in sustainable cotton good quality production, and favorable international market conditions. The company has main ability to innovate and adapt to trending market demands will be critical in maintaining its leadership in the cotton industry.

Read more : Tilak Ventures Share Price Target 2025

FAQ

1) What is the share price target for Axita Cotton in 2025?

If this company grows in the same way, then Axita Cotton Share Price Target 2025 can be between 24 to 40 rupees.

2) What is the share price target for Axita Cotton in 2026?

If this company grows in the same way, then Axita Cotton Share Price Target 2025 can be between 45 to 75 rupees.

3) What is the share price target for Axita Cotton in 2027?

If this company grows in the same way, then Axita Cotton Share Price Target 2025 can be between 80 to 110 rupees.

Conclusion

In this article, we have given the possibilities of Axita Cotton Share Price Target from 2025 to 2050 in detail only after analyzing the financial condition of Ashapuri Gold Limited Company for the last 10 years. Before giving all these possibilities, fundamental of technical analysis of the current financial condition of this company has also been done. After reading this article, you can also guess the future of this company. To get similar information, you can read the rest of the games given on this website and follow us on social media.

Disclaimer

All the information given above is for educational purpose. Before investing, definitely take advice from your financial advisor. Because we are not SEBI registered advisors. This platform is not responsible for your financial loss

We have been investing and researching the stock market for the last 8 years. We try to provide free information on this website in simple language.

Contents

- 1 Axita Cotton Company Information

- 2 Axita Cotton Financial Overview

- 3

- 4 Axita Cotton Share Price Target 2025

- 5 Axita Cotton Share Price Target 2026

- 6 Axita Cotton Share Price Target 2027

- 7 Axita Cotton Share Price Target 2030

- 8 Axita Cotton Share Price Target 2040

- 9 Axita Cotton Share Price Target 2050

- 10 FAQ

- 11 Conclusion