Friends, if you want to know all the possibilities of Subex Share Price Target 2025 to 2050 and how Subex Limited can give returns in the future, then you have come to the right place. In this article, we have tried to give the possibilities only after analyzing the financial position of Subex Limited Company for the last 10 years. Along with this, how this company is performing at the present time, all the possibilities have been told by doing fundamental and technical analysis of the company. If you are thinking of investing in this company, then after reading this article you will be able to know the future of the company easily. So let’s know in detail what can be the Subex Limited Share Price Target in the future?

Subex Ltd Information

Subex Limited Company was established in 1992. This company works in software production in the IT sector. The main work of this company is to focus on privacy, risk reduction, security, trust in the telecommunications sector, prepare products for communication services at the international level. This company is an AI company which currently works as a consultant for operational excellence and business transformation for global telecom carriers. Along with this, the company also helps to run new models, enhance customer experience.

Major Customers: The major customers of Subex Limited Company are Airtel, Vodafone Idea, Jio, Optus, DST, UNE etc.

Major Services: This company provides many basic services like telecom sector, manufacturing, public sector, transportation, oil and gas.

Subex Ltd Financial Overview

While investing in any company, every investor must know the financial position of the company. That is why we have tried to give the financial position of Subex Limited Company with the help of ratios below. With this financial overview, you will be able to know the truth of the company before investing in the company.

| Subex Ltd |

Ratios |

| Market Cap |

₹ 1534 Cr |

| Face Value |

₹ 5 |

| Book Value |

₹ 5.92 |

| PE ratio |

… |

| ROCE ratio |

-5.48% |

| ROE ratio |

-12.2% |

| Dividend Yield |

00 % |

| 52-wk high |

45.8 Rs |

| 52-wk low |

22.4 Rs |

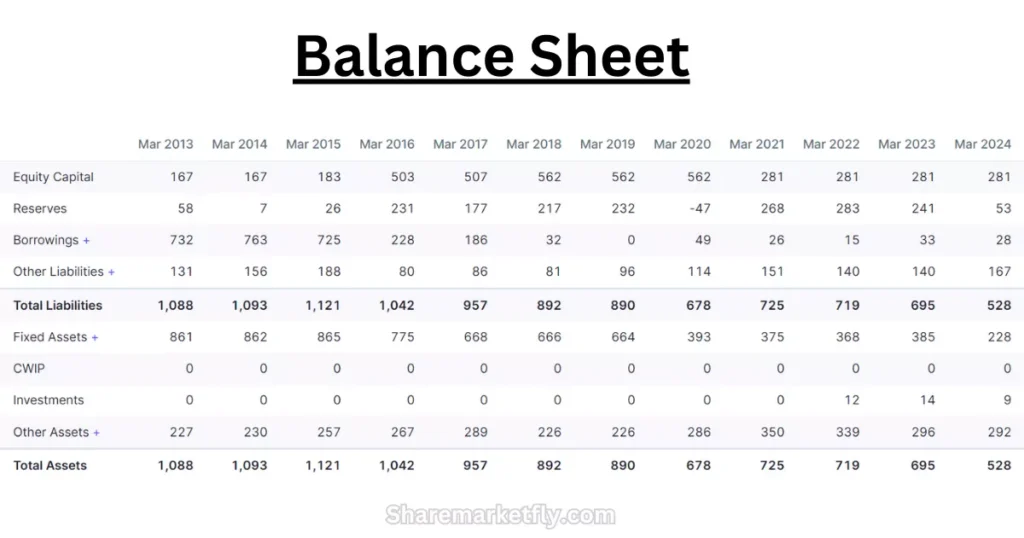

To know the financial analysis in detail, take the help of this balance sheet.

Subex Share Price History Of Last 10 Years

The share price of Subex Limited Company was trading around Rs 190 in 2005. From 2005 to 2007, there was a bullish environment in the stock of this company. From 2007, the bullish environment ended and recession started. In February 2007, the share price of the company was more than ₹ 700. But the bearish environment that started from 2007 continued till 2009. The stock which was trading at ₹ 700 in 2007 came straight to ₹ 25 in 2009. From 2009 to 2012, this stock was trading below ₹ 100. From 2012 to 2020, the stock of the company was trading below ₹ 30. After 2020, the company’s stock is again showing a bullish environment. Which is currently trading around ₹ 27.

Subex Share Price Target 2025

In 2030, the company’s sales were Rs 82 crore, which has increased to 84 crores in 2024. In the last 10 years, the company’s compound sales growth went negative. But last year this growth has been 18%. This company is almost debt free. If the company works in the same way in the future, then Subex Share Price 2025 Target can be like this

| Subex Share Price Target 2025 |

Rs |

| First Target |

29 |

| Second Target |

32 |

| Third Target |

35 |

After doing the current financial analysis of the company, Subex Share Price Target 2025 can be between Rs 29 to ₹ 35.

Subex Share Price Target 2026

In 2023, the company’s operating profit was only Rs 1 crore, which has increased to 3 crores in 2024. But the bad thing here is that the company’s net profit has decreased in 2024 as compared to 2023. Along with this, the company’s equity return is only two percent in the last 10 years. And has gone negative last year.

| Subex Share Price Target 2026 |

Rs |

| First Target |

40 |

| Second Target |

46 |

| Third Target |

55 |

The company’s net cash flow was around 50 crores in 2020 and 2021. Which has been reduced to 15 crores in 2023 and 24. Keeping all these things in mind, Subex Share Price Target 2026 can be between ₹ 40 to 55 rupees.

Subex Share Price Target 2027

The company’s stock is trading at about 4.6 times its book value. This company is currently giving low interest coverage ratios. In the last 5 years, the company’s sales growth has been negative 2.31%. If the company’s condition remains the same, then the target can be like this in 2027.

| Subex Share Price Target 2027 |

Rs |

| First Target |

60 |

| Second Target |

75 |

| Third Target |

82 |

If the company improves its current financial position, then the Subex Share Price Target 2027 can be between ₹ 60 to ₹ 82.

Subex Share Price Target 2030

Both sides of the company must be looked at. The negative side of the company is that from 2021 to 2024, the total assets of the company are showing a decline. But the good thing is that the company has kept the total liability and total assets balanced. That is why the company’s target in 2030 can be similar.

| Subex Share Price Target 2030 |

Rs |

| First Target |

210 |

| Second Target |

275 |

| Third Target |

320 |

In 2023, the total assets of the company were Rs 695 crores, which have come down to Rs 528 crores in 2024. Keeping these things in mind, if the company improves its financial position, then the Subex Share Price Target 2030 can be between Rs 210 to Rs 320.

Subex Share Price Target 2040

So the company has given 12% CAGR in 10 years. But the company has not lived up to the expectations of investors. But if the company improves its financial position further and increases sales, then the target in 2040 can be like this.

| Subex Share Price Target 2040 |

Rs |

| First Target |

720 |

| Second Target |

830 |

| Third Target |

940 |

If the company further develops its products and focuses on sales, the company’s revenue can increase. With increased revenue, the company’s profit can also increase, so Subex Share Price Target 2040 can be between Rs 720 and Rs 940.

Subex Share Price Target 2050

India can become a superpower in 2050. India’s economy is going to benefit from this. India’s economy is also going to grow very fast. Along with India’s economy, all the companies of India can also grow very fast. If this company takes advantage of this environment, then the target in 2050 can be like this.

| Subex Share Price Target 2050 |

Rs |

| First Target |

1820 |

| Second Target |

2050 |

| Third Target |

2230 |

Looking at the history of the company and analyzing the current financial situation, Subex Share Price Target 2050 can be between Rs 1820 and Rs 2230.

Subex Ltd share holder’s

While investing in any company, one must take information about the shareholders of the company. That is why the list of shareholders of Subex Limited Company is given below.

| Subex Shareholders |

Percentages (2024) |

| Promoters |

00 |

| FIIs |

1.08 |

| DIIs |

0.01 |

| Public |

97.53 |

| Other |

1.78 |

FAQ

1) What can be the Subex Share Price Target in 2025?

If the company improves its financial position, then Subex Share Price Target can be between ₹ 29 to ₹ 35 in 2025.

2) What can be the Subex Share Price Target in 2026?

Given the current financial position of the company, Subex Share Price Target can be between ₹ 40 to ₹ 55 in 2026.

3) What can be the Subex Share Price Target in 2027?

If the company increases its profit, then Subex Share Price Target can be between ₹ 60 to ₹ 82 in 2027.

4) What can be Subex Share Price Target in 2030?

If the company further increases its returns, then Subex Share Price Target can be between ₹ 210 to ₹ 320 in 2030.

5) What can be Subex Share Price Target in 2040?

If the company further improves its financial position, then Subex Share Price Target can be between ₹ 720 to ₹ 940 in 2040.

Conclusion

Before investing in any company, one must know the history and current financial position of the company. In this article, before giving all the possibilities of Subex Share Price Target 2025 to 2050, we have emphasized on the history of the last 10 years of the company. Along with this, an attempt has been made to understand the current financial position. Future prospects have been given only after doing fundamental and technical analysis of the current financial position of the company’s financial position of the last 10 years. After reading this article, you will be able to easily analyze the company yourself. To get more such information, you can read the rest of the articles given on our website, and if possible, you can follow us on social media.

Disclaimer

The information given above is for educational purposes. After reading this article, please consult your financial advisor before investing. This platform is not responsible for your financial loss. Because we are not

SEBI registered advisors.

We have been investing and researching the stock market for the last 8 years. We try to provide free information on this website in simple language.

1 thought on “Subex Share Price Target 2025, 2026, 2027, 2030, 2040, 2050”